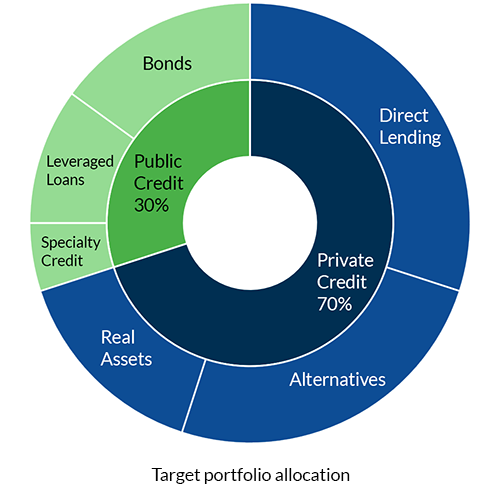

Private Credit

Direct Middle Market Lending: Our direct middle market lending strategy emphasizes active management of private floating-rate loans, enabled by our unique opportunities as a scale player with strong partners and the ability to tolerate illiquidity. By leveraging our broad access to credit opportunities, we deliver superior risk-adjusted returns for our clients while enhancing our portfolio with private market premia.

Alternatives (Structured Credit/Capital Solutions/Distressed Debt): We partner with private companies to offer flexible capital solutions in the form of actively managed, high-yield or floating rate loans. These special situation/distressed loans play an instrumental role in providing our total portfolio with diversification and private market premia.

Real Assets: We partner with private real estate and infrastructure companies to offer flexible capital solutions in the form of actively managed, high yield or floating rate loans. These loans play an instrumental role in providing the total portfolio with diversification and private market premia.

Public Credit

Bonds: Our bond strategy includes allocations to investment grade and high-yield bonds. Our strategy is grounded in active management, delivering a high yield, liquid asset class that contributes to the total portfolio’s stability. Through robust credit analysis and a disciplined approach, we continually adapt to market dynamics, such as interest rate moves, to optimize investment performance.

Leveraged Loans: Our leveraged loans strategy invests in diversified portfolios of actively traded broadly syndicated loans from below investment-grade issuers. These loans are typically at the top of the capital structure and secured by the borrower’s assets, providing higher recovery rates and reducing portfolio volatility. The floating rate nature of these investments neutralizes interest rate risk, while providing the portfolio with income and the potential for capital appreciation.

Specialty Credit: Our specialty credit strategy actively manages unique, floating-rate instruments, capitalising on market inefficiencies to extract relative value. These investments add diversification, public market premia and liquidity to our total portfolio, reinforcing its resilience and adaptability to varying market conditions.

Our Investment Strategy in Action

-

IMCO's Head of Global Credit Jennifer Hartviksen receives PEI's Women of Influence award

-

ION Analytics Podcast: IMCO's Head of Global Credit Jennifer Hartviksen shares her views on structural shifts, risks, and opportunities in today's credit markets

-

Jennifer Hartviksen shares her perspective on private credit

-

Investing Between the Lines: IMCO's Evolving Approach to Global Credit

-

Adding actively managed public credit exposure for diversification and attractive, risk-adjusted return potential

-

Private Debt International: From the ground up – The Canadian LP building things differently

-

Building our standalone Global Credit portfolio through private direct lending

Select Strategic Partners

Management team

-

Craig Ferguson

Senior Managing Director, Head of Private Equity and Global Credit -

Jennifer Hartviksen

Managing Director,

Head of Global Credit -

Amit Dutta

Managing Director, Global Credit -

Fernando Martinez

Managing Director, Global Credit