Capital Deployment

Capital deployment means putting our money to work to achieve IMCO’s sustainability goals and maintain a high-quality, resilient portfolio for the long term.

As a PRI signatory, we integrate material sustainability factors into every stage of the investment lifecycle, including the use of external managers. IMCO's Sustainability Screening Guideline describes our process for selecting companies, sectors and/or activities. We strive to apply consistent principles and processes across IMCO while adapting our approach to each asset class.

"Sustainability risks and opportunities are part of the underwriting process, like any other element of due diligence.

We are in the business of generating long-term returns, so all material factors that could impact those returns, such as climate, are considered across all asset classes."

- Rossitsa Stoyanova, Chief Investment Officer

Selecting and Monitoring External Managers

External managers are essential to diversifying and executing our investment strategies. They complement our in-house managers by filling gaps in our expertise or providing efficient exposure to select sectors and markets.

IMCO partners with external managers that share our commitment to sustainability. We encourage managers to commit to net zero, disclose ESG metrics and uphold strong diversity, equity and inclusion (DEI) policies. When selecting external managers, we evaluate such practices as:

- Integration of material ESG-related issues in the investment process

- Firm-level sustainability commitments

- Approach to stewardship

- Available ESG reporting

We use our proprietary external manager assessment scorecard to evaluate the maturity of a manager’s sustainability integration, as well as an ESG dashboard to track their sustainability commitments.

The table below showcases some examples of the many indicators we track.

| Metrics | External managers as % of AUM (as of Dec. 31, 2023) |

External managers as % of AUM (as of Dec. 31, 2024) |

|---|---|---|

| ESG policy | 90% | 97% |

| UN PRI signatory | 84% | 93% |

| Net zero target(s) | 42% | 46% |

| DEI policy | 74% | 82% |

"There is a level of sustainability integration we expect from managers and a mindset of partnership is important. We collaborate closely and often learn from each other."

- Ken Bona, Portfolio Manager, Public Markets

Investing in Climate Solutions

As a steward of client capital and a global investor, IMCO endeavours to play our part in the transition to a net zero economy. This transition offers numerous sustainable, long-term investment opportunities that we expect will deliver strong investment returns for our clients.

Capital deployment is the first pillar of IMCO's Climate Action Plan. We pursue opportunities that contribute to investment returns while having a climate-positive impact. We mitigate risk through climate-related due diligence and the thoughtful use of climate guardrails.

We define climate solutions as companies or projects that derive most of their business from products or services that reduce emissions or otherwise mitigate climate change effects. Clean energy transition investments are a subset of climate solutions that further the transition to a lower-carbon economy.

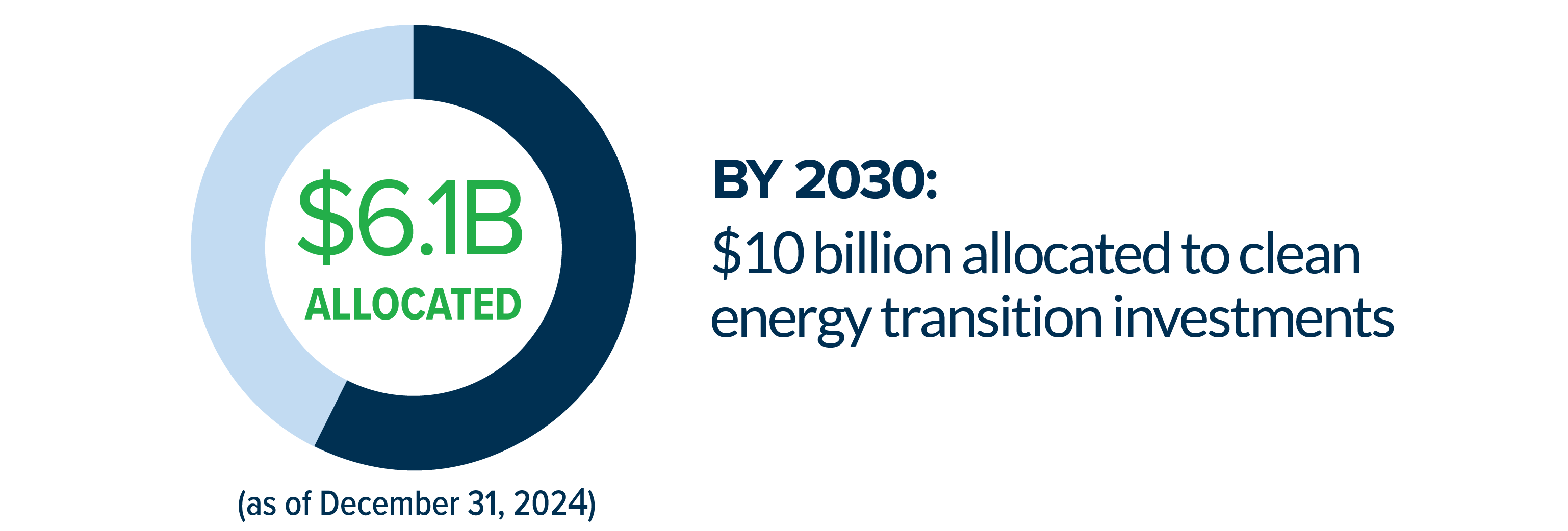

We have set a target to deploy $10 billion in climate solutions between 2020 and 2030.

Investing in Social Solutions

In alignment with our World View, IMCO believes there are powerful, long-term societal trends that are expected to present investment opportunities while addressing socioeconomic challenges.

Social solutions are defined as investments where a majority of the company’s business is derived from activities that provide or enhance social necessities, such as access to essential services, affordable basic infrastructure, affordable housing and food security.

Unlocking human capital is also one of IMCO's areas of focus, where we seek to advance matters like DEI, health and safety, and employee ownership to enable a talented workforce to fulfill its potential.

Case Studies

Scala Data Centers

In 2024, IMCO invested in Scala, a leading hyperscale data center provider headquartered in Brazil. Scala designs, builds and operates mission-critical infrastructure for hyperscale and cloud customers across Latin America. Since its founding in 2020, Scala has operated with 100% clean energy and maintained zero water loss. It has also raised over US$1.1 billion through green bonds, leveraging its sustainability strengths to fund continued growth. Scala's commitment to ESG leadership has earned it multiple accolades, including being named as Latin American Sustainability Champion by the World Bank and winning the Sustainable Finance Award for two consecutive years at the Global Sustainability & ESG Award. IMCO's investment reflects our strategy to support high-quality infrastructure platforms that advance energy transition and digital connectivity across the globe.

OBHG

IMCO invested in OB Hospitalist Group (OBHG) in 2021 alongside our strategic partner, Kohlberg. OBHG is the largest and only dedicated obstetrics hospitalist provider in the U.S., providing 24/7 on-site obstetric coverage for 300+ hospitals. OBHG’s programs have resulted in notably better patient outcomes, exceeding national goals, including a 30% reduction in serious harm events, a 10% reduction in C-section rates and 75% fewer births resulting in malpractice payouts. Additionally, OBHG’s reach and ability to serve hospitals of all sizes are improving access to care by closing geographic gaps in maternity care.

One Helix

IMCO's inaugural European life science development project, One Helix, is a 55,000-square-foot biotech research facility in Amsterdam delivered through our investment in Breakthrough Properties Fund I. Fully leased to AstraZeneca on the Amsterdam University Medical Center campus, the state-of-the-art facility sets a new benchmark for sustainable commercial lab development, with environmental performance prioritized from the initial design stage through construction and ongoing operations. The project achieved BREEAM ‘Outstanding’ Fully-Fitted and BENG-2 performance ratings and will aim to be carbon negative in its operations.

The building was developed using 50% less embodied carbon versus a standard office building. It is also designed for deconstruction through separable building layers that can be reused, extending the building’s lifecycle and minimizing future waste. Sustainable features are embedded throughout the facility, including geothermal energy storage, triple-glazed glass façade with solar shading, water retention infrastructure, green spaces, habitat preservation, and tenant wellbeing enhancements - all of which makes the asset more resilient, reduces operating costs and strengthens long-term tenant appeal.

This investment demonstrates how environmental leadership can generate both strategic and financial value, while advancing high-performance real estate and innovation.

Algoma Hydro

IMCO invested in Algoma Hydro in 2018 alongside four co-investors, including Brookfield Energy Partners. Algoma Hydro operates a portfolio of 14 hydro assets in Northern Ontario and British Columbia with a combined capacity of 413 megawatts. The assets play an important role in delivering clean power to a supply mix undergoing significant change, particularly in Ontario where retirements and refurbishments of nuclear facilities have the potential to strain capacity. More than half of Ontario’s electricity use is supplied by nuclear power.

NeXtWind

IMCO acquired NeXtWind alongside co-investors Sandbrook Capital and PSP Investments in 2023. NeXtWind is a German renewable energy company specializing in acquiring and rejuvenating end-of-life wind turbines. These assets are often well located but lacks efficiency. By replacing them with newer, larger and more efficient turbines, NeXtWind can achieve yields up to four times the average wind output. Approximately 30% of Germany’s installed wind capacity have been in service for over 15 years, presenting a significant opportunity to modernize and expand clean power generation. NeXtWind is also contributing to the country’s ambitious carbon reduction goals. In 2024 alone, over 220,000 tonnes of CO2 emissions - equivalent to the energy consumed by around 30,000 homes annually – were avoided thanks to NeXtWind’s turbines. The company continues to scale its operations, increasing capacity by 46% in 2024 from 2023.

Florida Food Products

IMCO partnered with Ardian to invest in Florida Food Products, which makes healthy, naturally sourced plant-based ingredients that provide alternatives to artificial food additives. The company also supplies natural beverage ingredients, as well as custom ingredients to improve the look and texture of meat alternatives. Its products replace synthetic ingredients and help extend shelf life. This improves access to safe, nutritious food. Effective food preservation also helps reduce food waste, which accounts for a significant portion of global GHG emissions.

Fifth Wall

IMCO invested in the Fifth Wall Climate Tech funds, the largest investment vehicles designed to decarbonize the global real estate industry. The funds invest in essential tools for improving operational efficiencies and emissions reduction, such as property technology and digitization. In 2022, one of the funds invested in Brimstone, a company that makes zero-carbon cement using carbon-free silicate rock. Cement production is one of the most carbon-intensive industrial processes.

Blackstone

IMCO committed to the Blackstone Green Private Credit Fund III, which will provide flexible credit capital to companies and assets driving the energy transition, with a focus on renewable energy, energy transition, sustainability and climate change solutions.

Resource Innovations

IMCO invested in Resource Innovations, a third party provider of energy efficiency program management and advisory services to utilities across the U.S. The company designs, markets and implements demand side management programs for utilities to reduce energy consumption and carbon emissions from residential and commercial customers.