The way we communicate, work and connect with one another and the social ambitions around how we power all that we consume are forcing a rethink of the type of infrastructure necessary both now and in the future. We recognize that increased connectivity, digitalization and a global movement towards achieving net zero are reshaping the world and the infrastructure sector. To ensure our portfolio is prepared for the future, we invest in assets and emerging opportunities that deliver stable income and inflation protection over the long term.

Our growing global infrastructure team has deep sector expertise, is highly experienced, and takes an engaged, collaborative approach valued by strategic partners and portfolio companies. We invest directly and leverage strategic partnerships and external relationships to access untapped opportunities, constructing an efficient portfolio for our clients.

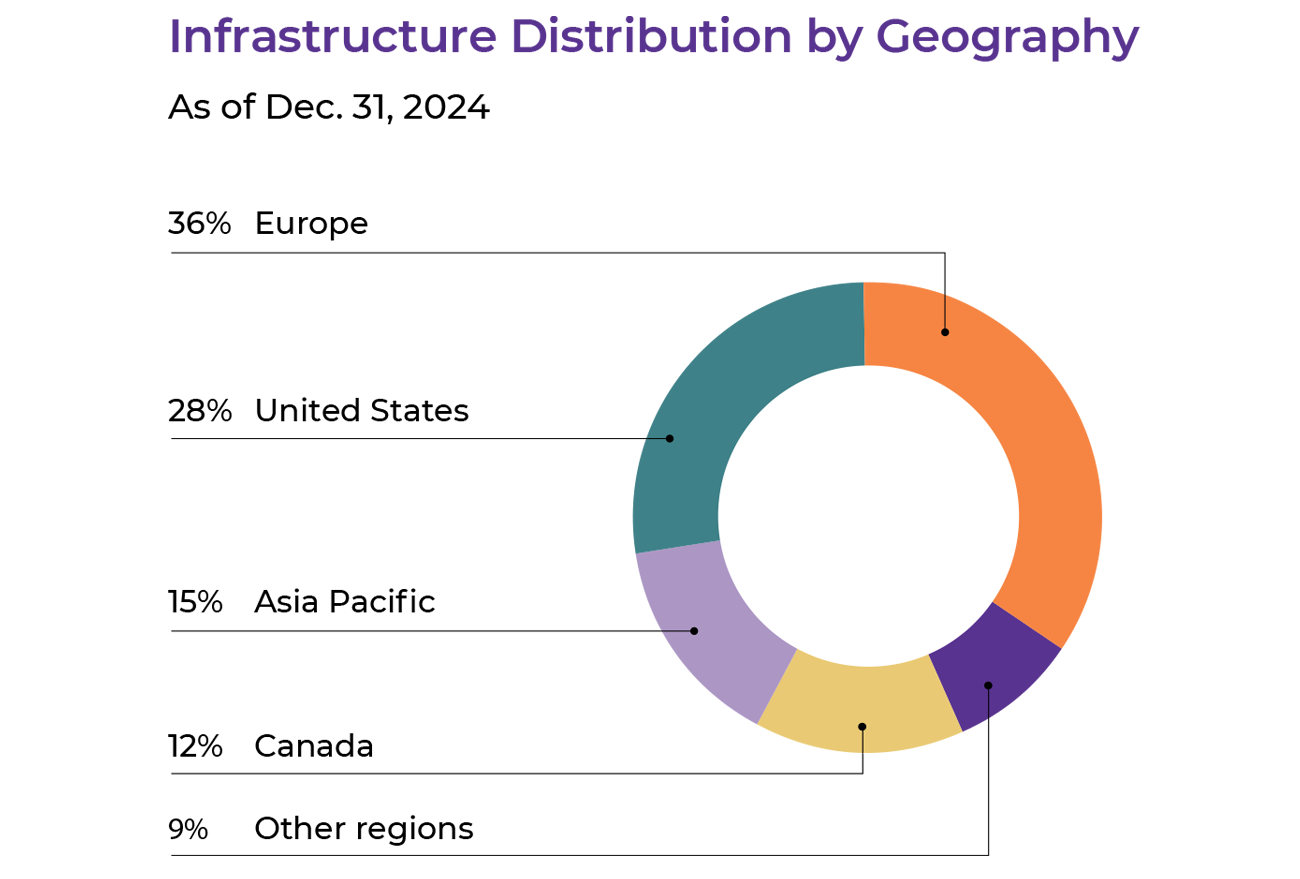

We consider opportunities in a wide array of top-tier private assets across geographies and invest in sectors where we can leverage our expertise to drive meaningful value. With clear objectives and a sound strategy, we aim to grow our Global Infrastructure portfolio to more than $12 billion by 2027 through fund commitments and direct investments.

Our portfolio companies share their perspectives on the value of IMCO's partnership.

Learn more about IMCO’s approach to clean energy transition investing.

Explore the values and partnerships that drive IMCO's success.

We recognize the importance of customer-centric business models and focus on value-enhancing activities by adopting a hands-on operational approach to maximize returns. Our investment activities focus on three key areas we believe represent the future of global infrastructure, and where we are differentiated as investors.

Digital Infrastructure

Digital infrastructure is becoming increasingly essential as the economy evolves, creating unprecedented demand for innovative and scalable solutions. Recognizing this shift, we invest in both cutting edge and core digital assets. Investments such as DataBank, the largest edge infrastructure operator in the US, euNetworks, a leading European bandwidth provider and Cellnex Nordics, a leading Scandinavian tower operator, provide upside exposure to digital disruptors such as artificial intelligence (AI), while minimizing the risk that can come with investing in emerging technology.

Clean Energy Transition

Navigating the rapidly changing landscape of the energy transition represents both a challenge and an unprecedented opportunity. Recent technological advances have made renewable energy sources cost-competitive and decarbonization of power not only feasible, but also a compelling opportunity to generate optimal risk adjusted returns for clients.

Commitments to achieve net-zero emissions have created significant tailwinds for renewable energy sources, and we are poised to capitalize on this potential. Our portfolio includes investments such as a wholly-owned leading utility scale battery storage platform in the UK, Pulse Clean Energy and German onshore wind producer, NeXtWind Capital Ltd.

Leveraging our unparalleled expertise and industry insights, our mission is clear: to drive sustainable growth, support innovative solutions, and actively shape the global energy sector for a greener future.

Regulated Utilities

The electrification of the global economy will necessitate long-term private capital to expand and re-enforce the regulated utility sector. IMCO is seizing this opportunity, with investments such as our take-private investment in AusNet Services Limited, a regulated utility business in Australia. As energy markets evolve, our strategy will mature to optimize returns for clients across the energy value chain.

Our Investment Strategy in Action

-

IMCO’s infrastructure push to power the energy transition

-

IMCO's strategic approach to digitalization and connectivity

-

Institutional Connect: IMCO's approach to digital infrastructure and AI

-

Sandbrook Capital alongside PSP Investments and IMCO, announces agreement to acquire NeXtWind, a leading German renewable energy company

IMCO's Select Investments

AusNet Services Limited

Description: Regulated utility

Location: Australia

Date of Investment: 2022

Cellnex Nordics

Description: Wireless towers

Location: Nordics

Date of Investment: 2023

DataBank

Description: Data centres

Location: USA

Date of investment: 2022

Highway 407 ETR

Description: Toll highway operator

Location: Canada

Date of investment: 2013

Pulse Clean Energy

Description: Utility scale batteries

Location: United Kingdom

Date of investment: 2021

Management team

-

Matthew Mendes

Managing Director, Head of Infrastructure -

Paul D'Angelo

Managing Director, Infrastructure -

Kenneth Koon

Managing Director, Infrastructure -

Fred Robert

Managing Director, Digital Infrastructure -

Alex Side

Managing Director, Infrastructure