Investment Strategies

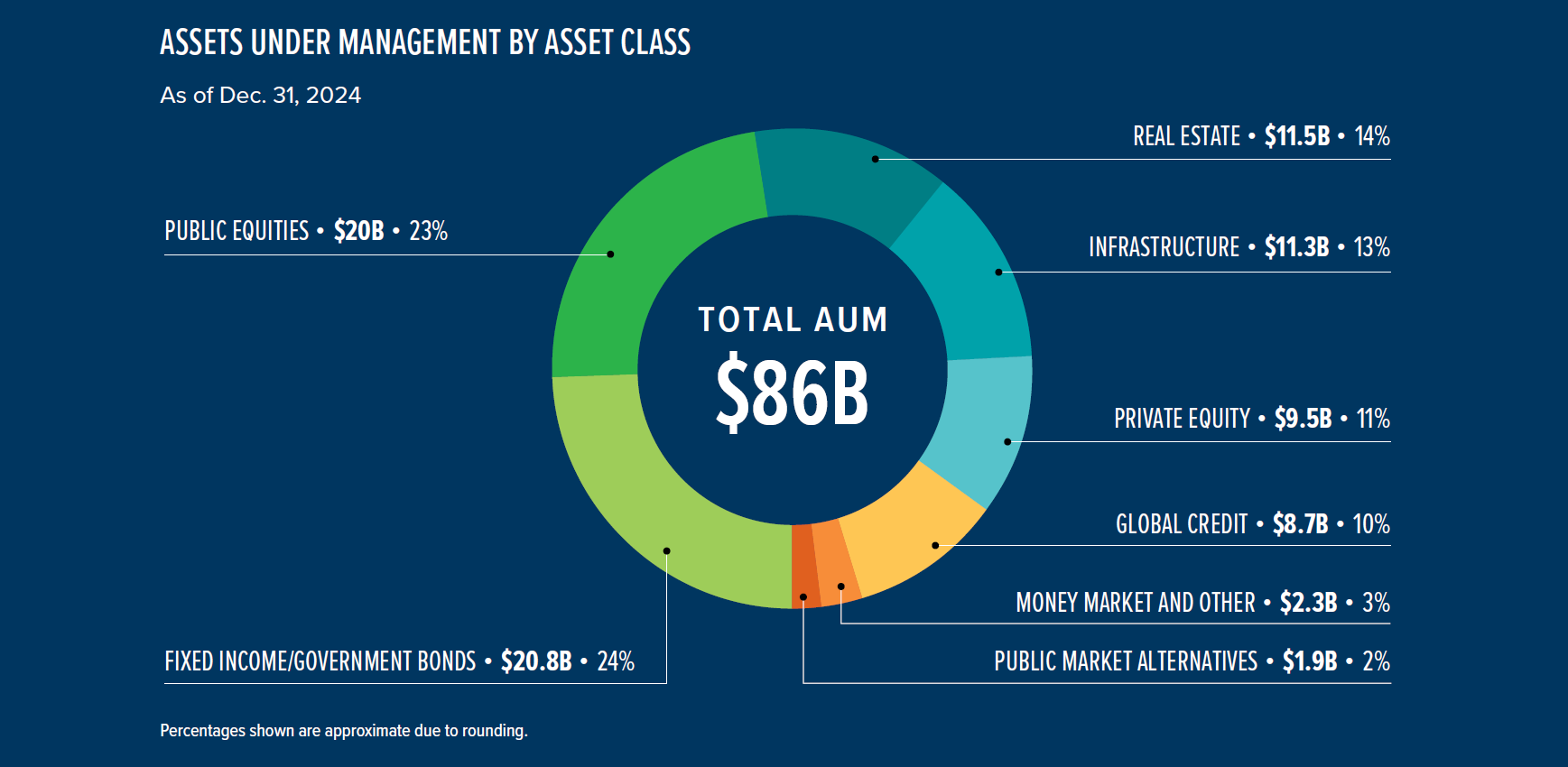

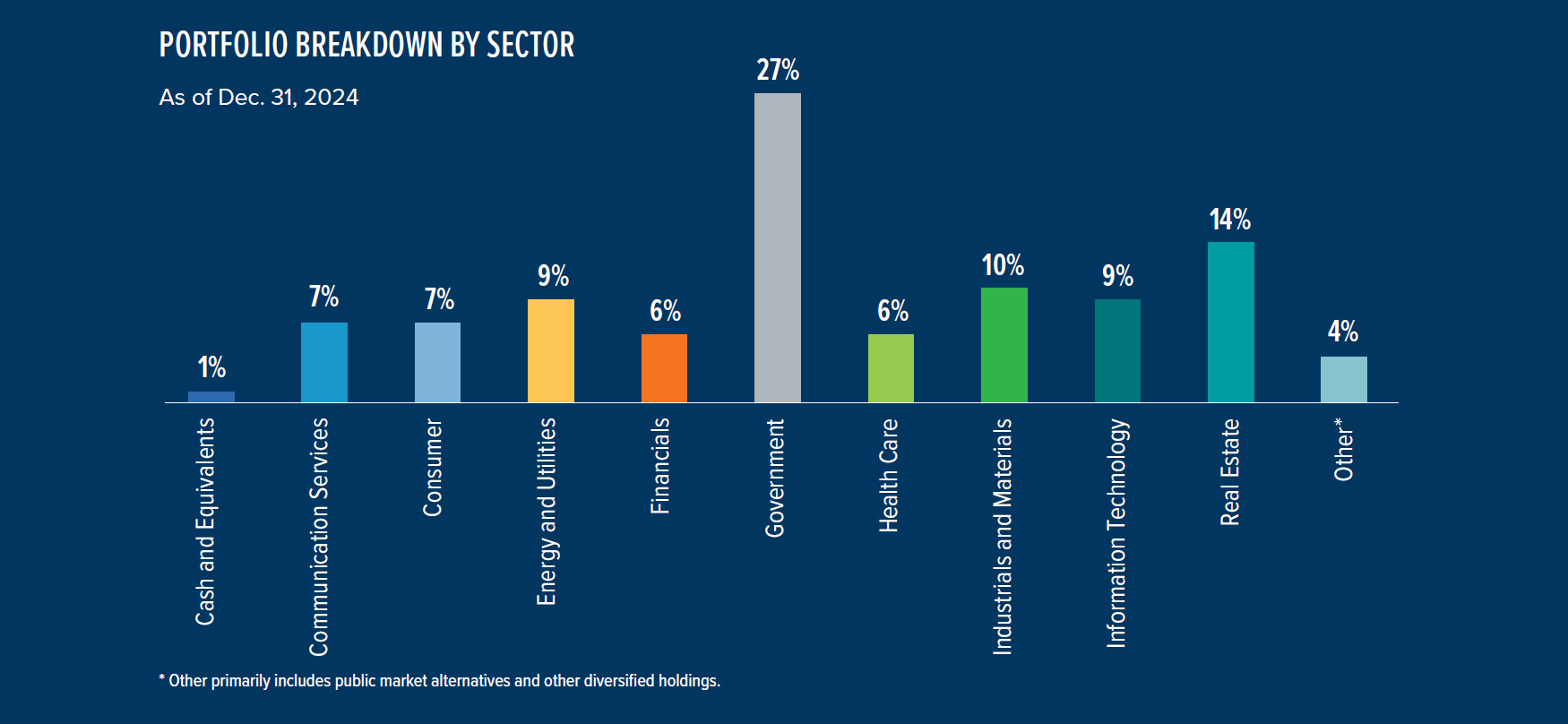

Asset Classes

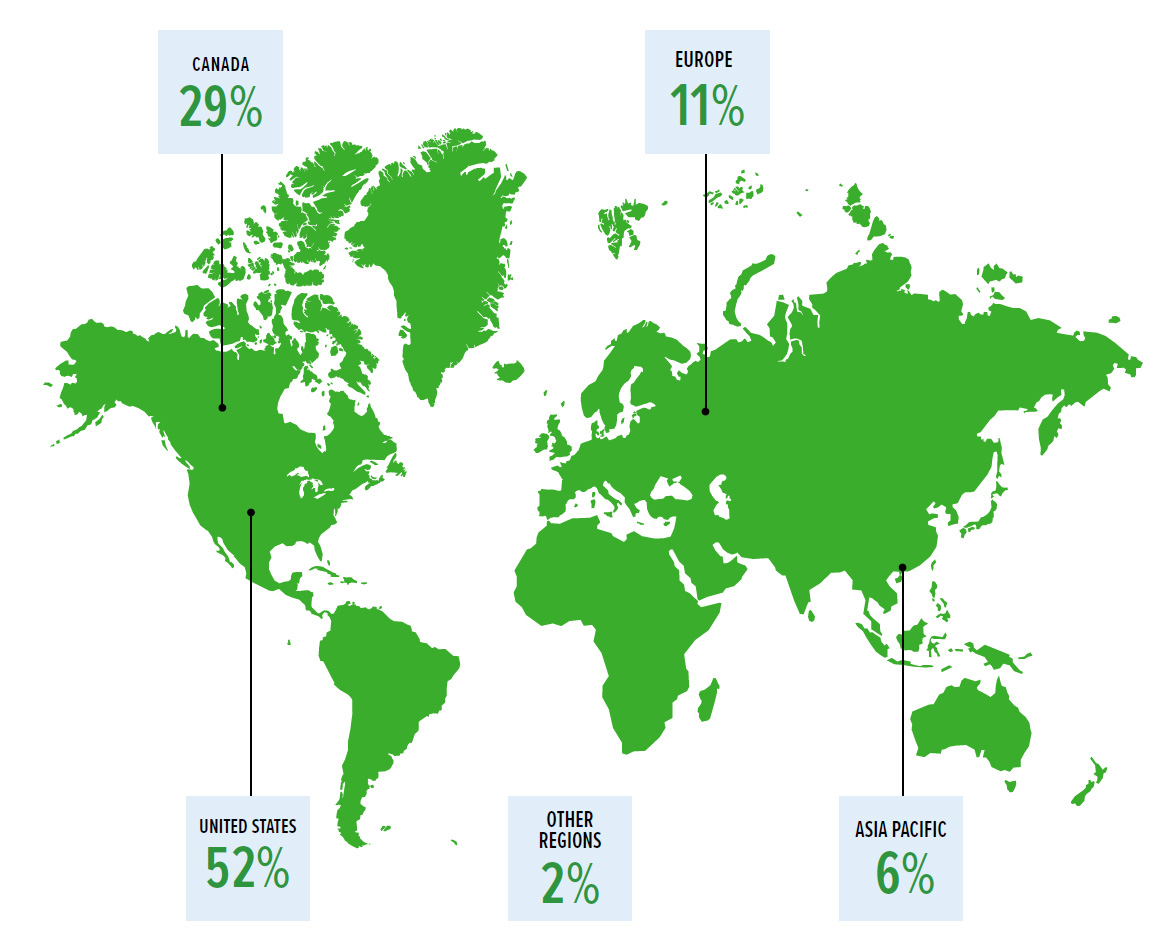

Regional Allocation of Assets Under Management

(As at Dec. 31, 2024)

Sustainable Investing

Since IMCO's formation, sustainable investing has been core to our approach as we firmly believe that sustainability factors can help us manage business risks and pursue opportunities to ensure the long-term viability of our clients' assets. Learn more about how we put this belief into practice.